Economic slowdown impacts commercial banks’ profit growth in Nepal

KATHMANDU: The ongoing economic slowdown in Nepal has hindered business expansion, affecting the balance sheets of commercial banks. In the first nine months of the current fiscal year, commercial banks reported a modest profit growth of just 1.4% compared to the same period last year, according to financial statements released by banks and financial institutions.

This marginal increase was largely supported by flexible policies from Nepal Rastra Bank (NRB), particularly in loan loss provisioning and the restructuring of loans in the construction sector.

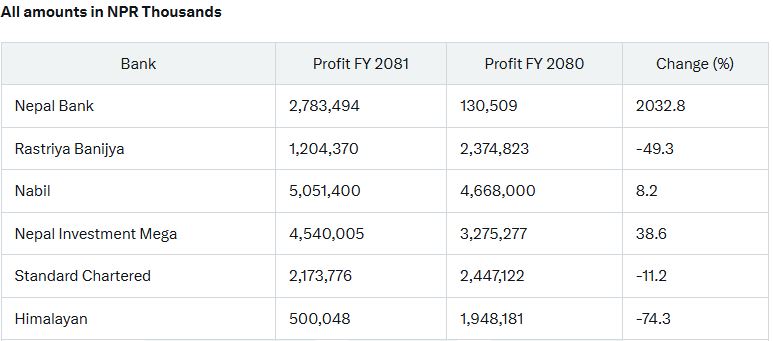

Collectively, 20 commercial banks earned a total profit of NPR 41.24 billion during this period. While 11 banks saw an increase in profits, nine experienced a decline. Nepal Bank led in profit growth with an extraordinary 2032.8% surge, earning NPR 2.78 billion. Meanwhile, Nabil Bank topped the list for the highest profit, recording NPR 5.05 billion with an 8.2% growth rate.

Bankers attribute the profit growth to NRB’s lenient measures, including the restructuring and rescheduling of construction sector loans and a reduction in the loan loss provision rate from 1.10% to 1%. Despite low demand for loans, these policies provided significant relief to the banking sector.

However, several banks, including Rastriya Banijya Bank, Standard Chartered, Himalayan, NIC Asia, Kumari, Siddhartha, Agriculture Development, Citizens, and Prime Bank, reported a contraction in profits.

Profit of Commercial Banks in Nepal (FY 2081 vs. FY 2080, 9 Months)

Facebook Comment