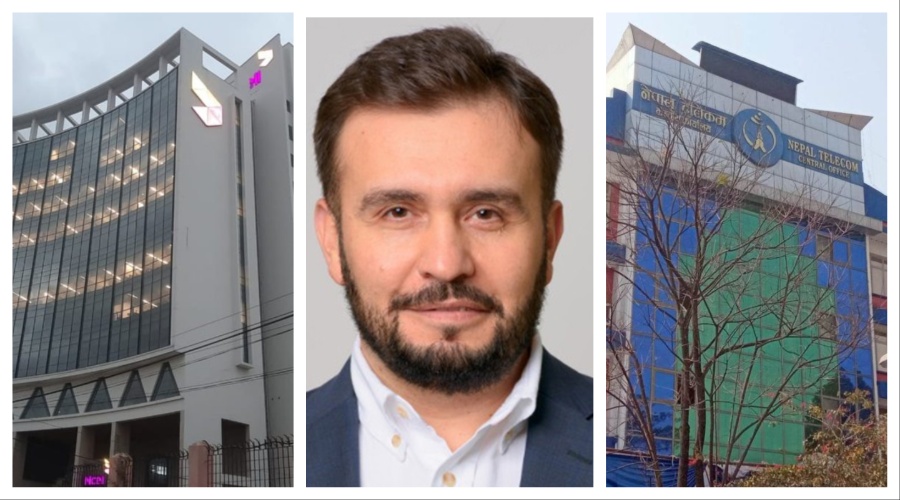

KATHMANDU: In an unprecedented address, Ncell Managing Director and CEO Jabbor Kayumov painted a dire picture of Nepal’s telecom sector, warning of an impending collapse if regulatory and policy issues are not addressed promptly. On Wednesday, Kayumov broke the mold of typical corporate press conferences by focusing not on Ncell’s grievances but on the broader challenges facing the industry.

“Telecom Failures Mean National Losses”

Kayumov’s remarks underscored the critical juncture at which Nepal’s telecom sector finds itself. “Nepal’s telecom sector is faltering,” he stated bluntly. “A failing telecom sector equates to the state losing its assets. The choice is clear: risk unpopularity to preserve these assets or continue down a path of popularity and inevitable loss.”

Highlighting the sector’s declining fortunes, he revealed that annual investments in telecom have plummeted from NPR 18 billion a few years ago to just NPR 6 billion today, directly impacting national revenue.

Dwindling Contributions to GDP

The statistics shared by Kayumov were striking. Over the past seven years, the telecom sector’s contribution to Nepal’s GDP has shrunk from 3.9% to a mere 1.8%. Revenue from mobile and internet services has dropped by 5%, contrasting sharply with growth trends in neighboring countries.

India, for instance, has seen a 112% increase in telecom revenue, while Bangladesh and Sri Lanka have recorded growth rates of 46% and 38%, respectively. Nepal’s telecom market size, which stood at NPR 102 billion in 2016/17, has since contracted to NPR 96.8 billion in 2022/23.

Why the Decline?

Kayumov attributed the downturn to multiple factors, including regulatory burdens, high license renewal fees, and the lack of timely policy reforms. He pointed to a stark disparity in renewal fees: while GSM mobile license renewal costs NPR 20 billion, internet service providers (ISPs) pay just NPR 300,000.

This discrepancy is particularly significant given that 77% of mobile users spend over 60% of their time on Wi-Fi rather than mobile data. Although 90% of Nepal is covered by 4G networks, only two out of ten users regularly use mobile data, with an average consumption of just 4GB per month—the lowest in South Asia.

Lessons from India

Kayumov advocated adopting policies similar to India’s, which have helped stabilize its telecom sector. He cited India’s subscription-based long-term model and regular price adjustments as measures that, though initially unpopular, have ensured the sector’s sustainability.

“A minimum monthly fee should be introduced for mobile services,” he suggested. “This may seem unpopular now, but it will provide a stable foundation for the telecom sector to grow.”

He also noted that utilities like electricity, water, and waste management charge minimum monthly fees, regardless of consumption. For example, electricity costs a minimum of NPR 80 per month, while water and waste management fees are NPR 100 and NPR 250, respectively.

The Impact of Regulatory Constraints

The telecom sector’s struggles have been exacerbated by regulatory policies. In 2018, the Telecommunication Service Charge (TSC) was raised from 10% to 13%, adding an annual burden of NPR 7 billion to operators.

Furthermore, a regulatory move to reduce interconnection charges from NPR 0.54 to NPR 0.10 per minute resulted in a loss of over NPR 3 billion annually for operators. Similarly, lowering outgoing local voice rates from NPR 1.99 to NPR 1.62 per minute caused an annual revenue dip of NPR 1.7 billion.

The introduction of stringent regulations on Digital Value-Added Services (DVAS) in 2021 also added NPR 4.5 billion in costs, further straining operators.

Challenges in Spectrum Utilization

Kayumov highlighted the inefficiency in spectrum utilization as another pressing issue. Despite 90% 4G coverage, spectrum usage remains suboptimal, with only 42% of the 2100 MHz frequency band being utilized.

“Maintaining service quality requires continuous investment,” he explained. “However, underutilized spectrum and mounting financial pressures make it challenging for telecom operators to sustain growth.”

The “Revenue Crash” Phenomenon

He described the situation as a “revenue crash,” a term increasingly used among telecom operators. The decline began during the COVID-19 pandemic when data prices were slashed, and ISPs aggressively entered the market, doubling their market share.

This competition, combined with regulatory constraints, has dealt a severe blow to telecom operators’ earnings.

The Future of 5G in Nepal

The future of 5G in Nepal looks bleak, according to Kayumov. Both Ncell and Nepal Telecom are unlikely to invest in 5G due to the lack of a viable return on investment.

“Every investment is made with an eye on returns,” he said. “Under current conditions, neither company sees 5G as a feasible option.”

Third Operator Unlikely

Despite government efforts to introduce a third operator, Kayumov dismissed the idea as unviable. “The telecom sector is in decline. In such a scenario, there’s no scope for a third operator to achieve profitability,” he argued.

A committee formed by the Nepal Telecommunication Authority is currently studying the feasibility of a third operator, with recommendations expected soon.

Welcoming Starlink with Caution

Kayumov also addressed the potential entry of Starlink into Nepal. While he welcomed the move, he expressed skepticism about its feasibility, citing Nepal’s challenging terrain and high service costs.

“Starlink’s minimum service fee is $20,” he noted. “Given Nepal’s market dynamics, this could pose a challenge for widespread adoption.”

The Need for Urgent Action

Kayumov’s address concluded with a call for immediate policy interventions to save the sector. He emphasized the need for regulatory reforms, including the adoption of minimum monthly fees and a more balanced approach to taxation and license renewal fees.

“The telecom sector is a critical driver of economic growth,” he asserted. “If we fail to act now, we risk losing not just investments but also the potential for innovation and progress.”

The challenges facing Nepal’s telecom sector are multifaceted, from regulatory burdens and declining revenues to the underutilization of resources. However, as Kayumov’s address highlighted, these challenges also present an opportunity for reform.

By adopting sustainable policies and addressing systemic inefficiencies, Nepal can revitalize its telecom sector and ensure its continued contribution to the nation’s economic development. As the government and stakeholders deliberate on the path forward, the stakes have never been higher.