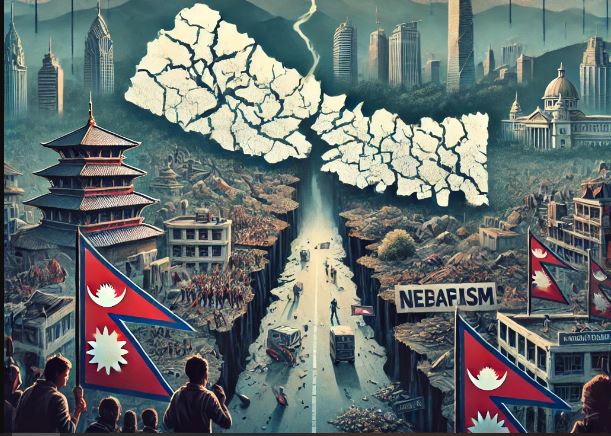

KATHMANDU: Nepal’s increasing dependence on foreign loans has raised serious concerns about the sustainability of its economy and the effectiveness of the federal governance system. With public debt skyrocketing and capital expenditures shrinking, experts warn that the current federal system could be on the brink of collapse, unable to handle the mounting financial obligations while delivering the promised development and services to the people.

As of October 2024, Nepal’s public debt has reached an alarming NPR 2.523 trillion, of which 51% is external debt. This growing dependence on foreign loans is not a new trend but has escalated dramatically in recent years, particularly after the 2015 earthquake and during the COVID-19 pandemic.

However, instead of utilizing these funds in productive sectors that could generate returns and boost the economy, much of the borrowing has been funneled into unproductive areas, including bureaucratic expenses and subsidies for inefficient state-run programs.

An Economy Built on Debt?

The numbers tell a worrying story. In just three months of the current fiscal year, public debt increased by NPR 88.83 billion. The government, instead of tightening its fiscal policies and encouraging domestic revenue generation, has resorted to external borrowing, exposing the economy to fluctuations in foreign currency exchange rates.

The depreciation of the Nepali Rupee against the U.S. Dollar, for example, has directly impacted the country’s debt liabilities, creating additional financial burdens.

Government borrowing is at its highest level, and the budget deficit continues to grow. The government has targeted raising NPR 547 billion in public debt this year alone, and as of October, it has already borrowed NPR 136.32 billion. While the federal system promised to bring governance closer to the people, enabling local and provincial governments to effectively manage resources and deliver services, the reality has been starkly different.

Federal System: Failing to Deliver?

The federal governance system, introduced in 2015 with much fanfare, is showing signs of structural failure. The federal model was meant to decentralize power and give local governments greater authority to address the needs of their constituencies. However, nearly a decade later, the system appears to be collapsing under its own weight.

Critics argue that the federal system has added unnecessary layers of bureaucracy, leading to inefficiency and corruption at both local and provincial levels. Funds that should be directed towards infrastructure, education, healthcare, and other critical areas are instead being spent on salaries, allowances, and administrative costs. Local governments, often lacking the capacity and expertise to manage large-scale projects, have failed to deliver on their promises, while provincial governments struggle to justify their relevance in the face of mounting financial crises.

The failure of the federal system is further compounded by the central government’s inability to properly allocate resources and manage the growing debt. While federalism was supposed to foster accountability and transparency, the current structure seems to have only amplified the nation’s financial woes, with multiple layers of government competing for limited resources and failing to implement effective development plans.

Growing Debt, Shrinking Capital Expenditure

The government’s capital expenditure has been steadily decreasing, a troubling sign for a country that desperately needs infrastructure development. As public debt continues to grow, the government has increasingly allocated funds towards debt servicing (interest and principal repayments) instead of productive investments. This vicious cycle of borrowing to pay off previous loans, without generating new income streams, has trapped Nepal in a debt spiral that could have long-term consequences for economic growth and stability.

For instance, in the current fiscal year, NPR 402 billion has been allocated for debt servicing, with NPR 83.08 billion already spent by October. This has left little room for capital investment, which is essential for job creation, economic stimulation, and long-term development. The capital expenditure budget has been consistently shrinking, while the financial management budget continues to grow, highlighting the government’s skewed priorities.

Implications for Nepal’s Future

The continuous rise in public debt, coupled with the federal system’s inefficiency, paints a bleak picture for Nepal’s future. Economists have already warned that the country could face significant financial risks if this trend continues. The reliance on external loans means that Nepal is vulnerable to global market fluctuations and changes in foreign aid policies. Moreover, the increasing debt burden on future generations could stifle economic growth for years to come.

At the heart of Nepal’s economic troubles lies the government’s failure to institute meaningful reforms and address structural issues within the federal system. While external borrowing can be a useful tool for development, it must be coupled with robust economic policies that encourage domestic revenue generation, minimize wasteful expenditures, and ensure that borrowed funds are used for productive investments.

The current federal structure, plagued by inefficiency and corruption, has failed to deliver the promised benefits to the people. If the government continues down this path, without addressing the underlying financial mismanagement, the federal system in Nepal risks becoming an expensive experiment in governance that will ultimately fail the people it was designed to serve.

The Road Ahead: Can Nepal Avert a Crisis?

Nepal is at a crossroads. To avoid a financial crisis and a collapse of the federal system, the government must take decisive action. This includes reforming the tax system to increase domestic revenue, reducing unnecessary bureaucratic expenses, and improving the efficiency of local and provincial governments. Additionally, greater oversight is needed to ensure that external loans are used for development projects that generate economic returns, rather than being squandered on administrative costs.

If these reforms are not implemented swiftly, Nepal’s reliance on foreign loans will continue to deepen, further undermining the federal system and pushing the country towards economic instability. The time for action is now—before it’s too late.