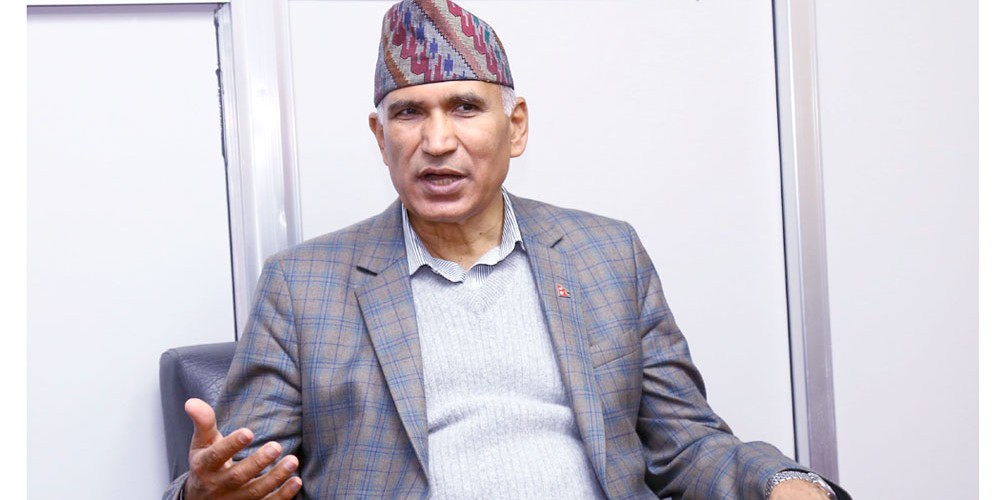

KATHMANDU: Deputy Prime Minister and Finance Minister Bishnu Paudel has announced that the government is preparing to amend existing laws to make the investigation and prosecution processes for banking offenses more structured and effective. Speaking at a meeting of the Finance Committee of the Federal Parliament on Sunday, Minister Paudel highlighted the growing incidents of banking offenses, particularly related to dishonored checks, and emphasized the need to address these issues through proper legal frameworks.

Minister Paudel explained that the proposed amendment, titled the “Banking Offenses and Penalties (Second Amendment) Bill 2080,” includes provisions that allow for settlements between the involved parties in cases of dishonored checks, commonly known as ‘check bounce’ offenses. The Finance Committee convened on Sunday to discuss the bill with the Finance Minister, focusing on the rising incidents of banking offenses and dishonored checks.

“The incidents of banking offenses and dishonored checks have significantly increased. This bill must be implemented as a law to make the investigation and prosecution processes more organized,” said Minister Paudel. “The proposed bill prioritizes financial penalties over imprisonment for offenses like check dishonor.”

The amended bill aims to address the practice of issuing checks without sufficient funds in the account and provides provisions for settlement between the parties if a check is dishonored due to legitimate reasons but can be paid later. “The law on dishonored checks needs to incorporate stricter policies while also providing some flexibility, which is why we are amending it,” Paudel explained. “The Banking Offenses and Penalties Act 2064 already includes some lenient provisions, which will be revised based on suggestions from the Office of the Attorney General and other stakeholders.”

Swarnim Wagle, Vice President of the National Independent Party, supported the idea of imposing financial penalties instead of imprisonment for banking offenses. “There is a global consensus on this approach, and it is appropriate for Nepal to follow suit,” Wagle said. “This is also a type of offense, and the amendment should ensure that offenders are penalized heavily enough to deter them from repeating the mistake.”

Member of Parliament Padam Giri criticized the weak legislative role of the parliament, noting that several bills are pending due to ineffective committee meetings. Giri’s concerns highlight the importance of passing the proposed amendment to strengthen the legal framework against banking offenses.

The Cabinet meeting on Saun 23, 2080, approved the draft of the “Banking Offenses and Penalties (Amendment) Bill 2080.” Subsequently, the then-Finance Minister Prakash Sharan Mahat registered the bill in Parliament on Ashoj 16, 2080.

The bill was drafted following a Supreme Court order and a study by the Office of the Attorney General, both of which highlighted the need to standardize legal remedies for dishonored checks. The bill includes provisions that prohibit individuals from issuing checks without sufficient funds in their accounts. “No one should issue a check or demand payment from the bank if they know that there are insufficient funds in their account or if the account balance is inadequate for payment,” the bill states.

The bill also proposes amendments to the penalties for banking offenses related to dishonored checks. Under the existing Banking Offenses and Penalties Act 2064, if a check is dishonored, the offender must pay the amount due along with a fine equal to the outstanding amount and may face up to three months in prison. However, the new bill stipulates that if it is proven that a check has been dishonored, the account holder who issued the check must pay the amount due to the check holder, along with a five percent penalty, and may face imprisonment based on the amount of the check.

The bill also includes provisions that allow the defendant in a dishonored check case to settle the matter by paying the amount mentioned in the check to the holder. “If both parties wish to settle the case during the investigation process, they may apply for reconciliation through the investigating officer, or if the case has already been filed in court, they may apply through the public prosecutor,” the bill states. “If an application for reconciliation is submitted, the public prosecutor must instruct the investigating officer to facilitate the reconciliation between the parties and record the details in the case file, after which the investigation may be suspended.”

The proposed amendments aim to strengthen the legal framework against banking offenses, ensuring that penalties are severe enough to prevent repeat offenses while also providing flexibility for genuine cases.