KATHMANDU: The central bank has unveiled the current macroeconomic and financial situation of Nepal based on nine months’ data ending mid-April, 2022/23.

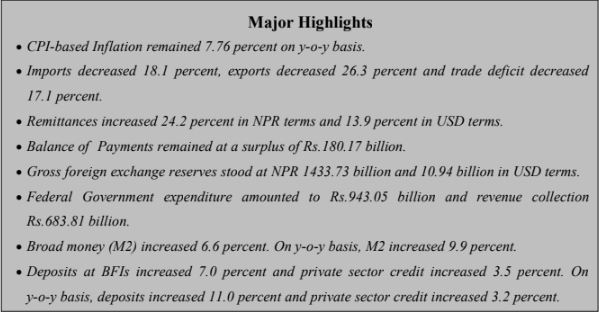

The Year on year consumer price inflation remained at 7.76 percent in mid-April 2023 compared to 7.28 percent a year ago. Food and beverage inflation stood at 6.93 percent whereas non-food and service inflation rose to 8.42 percent in the review month.

Under the food and beverage category, y-o-y price index of restaurant & hotel sub-category increased 14.68 percent, spices 14.67 percent, cereal grains & their products 13.72 percent, fruit 11.00 percent and tobacco products 10.83 percent.

Under the non-food and services category, y-o-y price index of health sub-category increased 10.39 percent, housing & utilities 9.54 percent, recreation & culture 8.81 percent, furnishing & household equipment 8.74 percent, and education 8.67 percent.

In the review month, consumer price inflation in the Kathmandu Valley, Terai, Hill and Mountain surged to 8.57 percent, 7.68 percent, 7.01 percent and 7.47 percent respectively. Inflation in these regions were 6.25 percent, 7.61 percent, 7.79 percent and 8.25 percent respectively a year ago. The y-o-y wholesale price inflation increased 5.59 percent in the review month compared to 14.42 percent a year ago.

The y-o-y wholesale price of consumption goods, intermediate goods and capital goods increased 0.21 percent, 8.88 percent and 5.18 percent respectively. The wholesale price of construction materials increased 6.14 percent in the review month. Salary and Wage Rate Index

The y-o-y salary and wage rate index increased 7.52 percent in the review month. Such growth rate was 8.52 percent a year ago. In the review month, salary index and wage rate index increased by 12.39 and 6.13 percent, respectively.

During the nine months of 2022/23, merchandise exports decreased 26.3 percent to Rs.118.28 billion against an increase of 69.4 percent in the same period of the previous year. Destination-wise, exports to India decreased 35.1 percent whereas exports to China and other countries increased 2.2 percent and 8.1 percent respectively.

Exports of zinc sheet, particle board, cardamom, woolen carpets, readymade garments, among others, increased whereas exports of soyabean oil, palm oil, oil cakes, textiles, jute goods, among others, decreased in the review period.

During the nine months of 2022/23, merchandise imports decreased 18.1 percent to Rs.1201.51 billion against an increase of 32.0 percent a year ago. Destination-wise, imports from India, China and other countries decreased 16.4 percent, 23.0 percent, and 19.4 percent respectively.

Imports of chemical fertilizer, sponge iron, petroleum products, gold, paper, among others, increased whereas imports of transport equipment & parts, medicine, M.S. billet, telecommunication equipments and parts, other machinery and parts, among others, decreased in the review period.

Based on customs points, exports from Bhairahawa, Dry Port, Kailali, Krishnanagar, Mechi, Nepalgunj, Rasuwa and Tribhuwan Airport Customs Offices increased whereas exports from all the other major customs points decreased in the review period. On the import side, imports from all the major customs points decreased in the review period.

Total trade deficit decreased 17.1 percent to Rs.1083.23 billion during the nine months of 2022/23. Such a deficit had increased 28.5 percent in the corresponding period of the previous year. The export-import ratio decreased to 9.8 percent in the review period from 10.9 percent in the corresponding period of the previous year.

During the nine months of 2022/23, merchandise imports from India by paying convertible foreign currency amounted Rs.101.67 billion. Such amount was Rs.167.53 billion in the same period of the previous year.

As per the Broad Economic Categories (BEC), the intermediate and final consumption goods accounted for 55.0 percent and 44.3 percent of the total exports respectively, whereas the ratio of capital goods in total exports remained negligible at 0.6 percent in the review period. In the same period of the previous year, the ratio of intermediate, capital and final consumption goods remained 47.2 percent, 0.02 percent and 52.7 percent of total exports respectively.

On the imports side, the share of intermediate goods remained 53.3 percent, capital goods 8.3 percent and final consumption goods remained 38.3 percent in the review period. Such ratios were 53.2 percent, 10.5 percent and 36.3 percent respectively in the same period of the previous year.

The y-o-y unit value export price index, based on customs data, increased 1.1 percent and the import price index increased 2.6 percent in the ninth month of 2022/23. The terms of trade (ToT) index decreased 1.5 percent in the review month compared to a decrease of 6.5 percent a year ago.

Net services income remained at a deficit of Rs.56.26 billion in the review period compared to a deficit of Rs.79.28 billion in the same period of the previous year. 17. Under the service account, travel income increased 94.3 percent to Rs.44.17 billion in the review period which was Rs.22.73 billion in the same period of the previous year.

Under the service account, travel payments increased 39.8 percent to Rs.91.60 billion, including Rs.67.19 billion for education. Such payments were Rs.65.54 billion and Rs.43.67 billion respectively in the same period of the previous year.

Remittance inflows increased 24.2 percent to Rs.903.39 billion in the review period against a decrease of 0.2 percent in the same period of the previous year. In the US Dollar terms, remittance inflows increased 13.9 percent to 6.92 billion in the review period against a decrease of 1.8 percent in the same period of the previous year.

Number of Nepali workers (institutional and individual-new) taking approval for foreign employment increased 51.5 percent to 387,839 in the review period. The number of Nepali workers (Renew entry) taking approval for foreign employment increased 5.5 percent to 217,959 in the review period. It had increased 199.9 percent in the same period of the previous year.

Net transfer increased 22.8 percent to Rs.996.88 billion in the review period. Such a transfer had decreased 0.4 percent in the same period of the previous year. Current Account and Balance of Payments

The current account remained at a deficit of Rs.51.82 billion in the review period compared to a deficit of Rs.510.58 billion in the same period of the previous year. In the US Dollar terms, the current account registered a deficit of 402.8 million in the review period compared to deficit of 4.27 billion in the same period last year.

In the review period, capital transfer decreased 24.0 percent to Rs.5.91 billion and net foreign direct investment (FDI) remained Rs.2.62 billion. In the same period of the previous year, capital transfer and net FDI amounted to Rs.7.78 billion and Rs.16.51 billion respectively.

Balance of Payments (BOP) remained at a surplus of Rs.180.17 billion in the review period compared to a deficit of Rs.268.26 billion in the same period of the previous year. In the US Dollar terms, the BOP remained at a surplus of 1.37 billion in the review period against a deficit of 2.25 billion in the same period of the previous year.

Gross foreign exchange reserves increased 17.9 percent to Rs.1433.73 billion in mid-April 2023 from Rs.1215.80 billion in mid-July 2022. In the US dollar terms, the gross foreign exchange reserves increased 14.8 percent to 10.94 billion in mid-April 2023 from 9.54 billion in mid-July 2022.

Of the total foreign exchange reserves, reserves held by NRB increased 20.6 percent to Rs.1273.99 billion in mid-April 2023 from Rs.1056.39 billion in mid-July 2022.

Reserves held by banks and financial institutions (except NRB) increased 0.2 percent to Rs.159.74 billion in mid-April 2023 from Rs.159.41 billion in mid-July 2022. The share of Indian currency in total reserves stood at 23.1 percent in mid-April 2023.

Based on the imports of nine months of 2022/23, the foreign exchange reserves of the banking sector is sufficient to cover the prospective merchandise imports of 11.0 months, and merchandise and services imports of 9.4 months.

The ratio of reserves-to-GDP, reserves-to-imports and reserves-to-M2 stood at 26.6 percent, 78.9 percent and 24.4 percent respectively in mid-April 2023. Such ratios were 24.6 percent, 57.8 percent and 22.1 percent respectively in mid-July 2022.

The price of oil (Crude Oil Brent) in the international market decreased 20.3 percent to US dollar 86.51 per barrel in mid-April 2023 from US dollar 108.49 per barrel a year ago. The price of gold increased 3.6 percent to US dollar 2048.45 per ounce in mid-April 2023 from US dollar 1976.75 per ounce a year ago.

Nepalese currency vis-à-vis the US dollar depreciated 2.69 percent in mid-April 2023 from mid-July 2022. It had depreciated 2.04 percent in the same period of the previous year.

The buying exchange rate per US dollar stood at Rs.131.03 in mid-April 2023 compared to Rs.127.51 in mid-July 2022.

During the nine months of 2022/23, total expenditure of the federal government according to data of Financial Comptroller General Office (FCGO), Ministry of Finance, stood at Rs.943.05 billion.

The recurrent expenditure, capital expenditure and financial management expenditure amounted to Rs.706.77 billion, Rs.107.24 billion and Rs.129.04 billion respectively in the review period.

In the review period, total revenue mobilization of Federal Government (including the amount to be transferred to provincial and local governments) stood at Rs.683.81 billion.

The tax revenue amounted Rs.616.12 billion and non tax revenue Rs.67.69 billion in the review period Cash Balance at various accounts of the GoN maintained with NRB remained Rs.191.37 billion (including Provincial Governments and Local Government Account) in mid-April 2023. Such balance was Rs.225.80 billion in mid-July 2022.

In the review period, total expenditure of provincial governments stood at Rs.92.13 billion. In the review period, total resource mobilization of provincial governments remained Rs.130.81 billion, of which the federal government transferred Rs.101.64 billion as grants and revenue from federal divisible fund and the provincial governments mobilized Rs.29.17 billion in terms of revenue and other receipts in the review period.

Broad money (M2) increased 6.6 percent in the review period compared to an increase of 3.5 percent in the corresponding period of the previous year. On y-o-y basis, M2 expanded 9.9 percent in mid-April 2023.

The net foreign assets (NFA, after adjusting foreign exchange valuation gain/loss) increased Rs.180.17 billion (16.2 percent) in the review period in contrast to a decrease of Rs.268.17 billion (20.1 percent) in the corresponding period of the previous year.

Reserve money increased 2.5 percent in the review period in contrast to a decrease of 15.3 percent in the corresponding period of the previous year. On y-o-y basis, reserve money increased 7.3 percent in mid-April 2023.

Domestic credit increased 5.0 percent in the review period compared to an increase of 10.7 percent in the corresponding period of the previous year. On y-o-y basis, domestic credit increased 8.6 percent in mid-April 2023.

Monetary Sector’s net claims on government increased 9.1 percent in the review period in contrast to a decline of 9.6 percent in the corresponding period of the previous year. On y-o-y basis, such claims increased 52.8 percent in mid-April 2023, which had increased 55.7 percent in mid-April 2022.

Monetary Sector’s claims on the private sector increased 4.3 percent in the review period compared to an increase of 13.7 percent in the corresponding period of the previous year. On y-o-y basis, such claims increased 4.0 percent in mid-April 2023.

Deposits at Banks and Financial Institutions (BFIs) increased Rs.355.89 billion (7.0 percent) in the review period compared to an increase of Rs.236.23 billion (5.1 percent) in the corresponding period of the previous year. On y-o-y basis, deposits at BFIs expanded 11.0 percent in mid-April 2023.

The share of demand, saving, and fixed deposits in total deposits stands at 8.0 percent, 25.7 percent and 60.1 percent respectively in mid-April 2023.

Such shares were 8.7 percent, 28.7 percent and 56.1 percent respectively a year ago.

The share of institutional deposits in total deposit of BFIs stands at 36.3 percent in mid-April 2023. Such a share was 38.6 percent in mid-April 2022.

Private sector credit from BFIs increased Rs.161.98 billion (3.5 percent) in the review period compared to an increase of Rs.550.64 billion (13.5 percent) in the corresponding period of previous year. On y-o-y basis, credit to the private sector from BFIs increased 3.2 percent in mid-April 2023.The shares of private sector credit from BFIs to non-financial corporation and household stand at 64.1 percent and 36.7 percent respectively in mid-April 2023. Such shares were 63.3 percent and 37.1 percent a year ago.

In the review period, private sector credit from commercial banks, development banks and finance companies increased 3.4 percent, 4.7 percent and 1.1 percent respectively.

In the review period, out of the total outstanding credit of the BFIs, 67.5 percent is against the collateral of land and building and 12.2 percent against the collateral of current assets (such as agricultural and non-agricultural products). Such ratios were 66.9 percent and 12.3 percent respectively a year ago.

In the review period, outstanding loan of BFIs to the agricultural sector increased 6.4 percent, industrial production sector 8.4 percent, construction sector 12.6 percent, transportation, communication and public sector 14.6 percent, wholesale & retail trade sector 4.2 percent, service industry sector 3.8 percent and consumable sector 3.4 percent.

In the review period, term loan extended by BFIs increased 19.1 percent, real estate loan (including residential personal home loan) 3.9 percent and trust receipt (import) loan 3.1 percent whereas overdraft loan decreased 65.8 percent (mainly due to reclassification of loan from the recent year), margin nature loan decreased 6.7 percent and hire purchase loan decreased 14.6 percent.

In the review period, NRB injected Rs.4449.09 billion liquidity on turnover basis of which Rs.413.94 billion was through repo, Rs.89.70 billion through outright purchase auction, Rs.2726.81 billion through standing liquidity facility (SLF) and Rs.1218.63 billion through Overnight Liquidity Facility (OLF).

During the period, the NRB absorbed Rs.5 billion liquidity through reverse repo auction. In the corresponding period of the previous year, Rs.5182.72 billion net amount of liquidity was injected through various instruments.

In the review period, NRB injected liquidity of Rs.557.81 billion through the net purchase of USD 4.27 billion from foreign exchange market. Liquidity of Rs.203.09 billion was injected through the net purchase of USD 1.68 million in the corresponding period of the previous year.

The NRB purchased Indian currency (INR) equivalent to Rs.462.14 billion through the sale of USD 3.54 billion in the review period. INR equivalent to Rs.419.18 billion was purchased through the sale of USD 3.50 billion in the corresponding period of previous year.

The outstanding amount of refinance provided by NRB remained Rs.5.77 billion in mid-April 2023.

As of mid-April 2023, the outstanding concessional loan remained Rs.205.11 billion extended to 147,807 borrowers.

Of which, Rs.139.65 billion has been extended to 61,200 borrowers for selected commercial agriculture and livestock businesses.

Likewise, Rs.62.28 billion loan has been extended to 83,751 women entrepreneurs. Total 2,856 borrowers have availed Rs.3.18 billion concessional loan in other specified sectors.

Business continuity loan has been extended to the Covid-19 affected tourism, cottage, small and medium industries for payment of salaries to workers and employees in line with ‘Business Continuity Loan Procedure, 2020’. The outstanding loan extended under this provision remained Rs.658.7 million as of mid-April 2023.

In the review period, BFIs interbank transactions amounted Rs.2982.69 billion on turnover basis including Rs.2715.90 billion inter-bank transactions among commercial banks and Rs.266.79 billion among other financial institutions (excluding transactions among commercial banks). In the corresponding period of the previous year, such transactions was Rs.2568.91 billion including Rs.2299.22 billion among commercial banks and Rs.269.68 billion among other financial institutions (excluding transactions among commercial banks).

The weighted average 91-days treasury bills rate remained at 9.74 percent in the ninth month of 2022/23, which was 7.58 percent in the corresponding month a year ago. The weighted average inter-bank transaction rate among commercial banks, which was 6.99 percent a year ago, increased to 7.00 percent in the review month.

The average inter-bank rate of BFIs which is considered as operating target of monetary policy stood 7.01 percent in the review month. Such a rate was 7.00 percent a year ago.

The average base rate of commercial banks increased to 10.48 percent in the ninth month of 2022/23 from 9.17 percent a year ago. Weighted average deposit rate and lending rate of commercial banks stood at 8.26 percent and 12.84 percent respectively in the review month. Such rates were 7.11 percent and 10.78 percent respectively a year ago.

After introduction of merger and acquisition policy aimed at strengthening financial stability, the number of BFIs involved in this process reached 259 as of mid-April 2023. Out of which, the license of 185 BFIs was revoked thereby forming 74 BFIs.

Of the total 753 local levels, commercial banks extended their branches at 752 levels as of mid-April 2023. The number of local levels having commercial bank branches was 750 a year ago.

The total number of BFIs licensed by NRB remained 119 in mid-April 2023 (Table 5). As of mid-April 2023, 21 commercial banks, 17 development banks, 17 finance companies, 63 microfinance financial institutions and 1 infrastructure development bank are in operation. The number of BFIs branches reached 11,643 in mid-April 2023 from 11,528 in mid-July 2022.

NEPSE index stood 1934.48 in mid-April 2023 compared to 2415.25 in mid-April 2022. Stock market capitalization in mid- April 2023 stood Rs.2813.55 billion compared to Rs.3426.11 billion in mid-April 2022.

Number of companies listed at NEPSE reached 248 in mid-April 2023. Out of the total listing, 141 are Bank and Financial Institutions (BFIs) and insurance companies, 69 hydropower companies, 19 manufacturing and processing industries, 6 investment companies, 6 hotels, 4 trading companies and 3 others. The numbers of companies listed at NEPSE were 229 in mid-April 2022.

Share of BFIs and insurance companies in stock market capitalization is 63.8 percent in mid-April 2023. Such a share for hydropower companies is 14.4 percent, investment companies 6.9 percent, manufacturing and processing industries 3.9 percent, hotels 2.1 percent, trading companies 0.4 percent and the share of other companies is 8.5 percent.

The paid-up value of 7.19 billion shares listed at NEPSE stood Rs.709.27 billion in mid-April 2023. Securities worth Rs.271.19 billion were listed at NEPSE during the first nine months of FY 2022/23. Such securities comprise ordinary share worth Rs.165.56 billion, government development bond worth Rs.35 billion, bonus shares worth Rs.31.84 billion, debenture worth Rs.29.19 billion, mutual fund worth Rs.5.49 billion and right share worth Rs.4.11 billion.

Securities Board of Nepal approved the total public issuance of securities worth Rs.30.35 billion in the review period which includes mutual fund worth Rs.12.15 billion, debenture worth Rs.11.20 billion, ordinary share worth Rs.6.05 billion and right share worth Rs.0.95 billion.