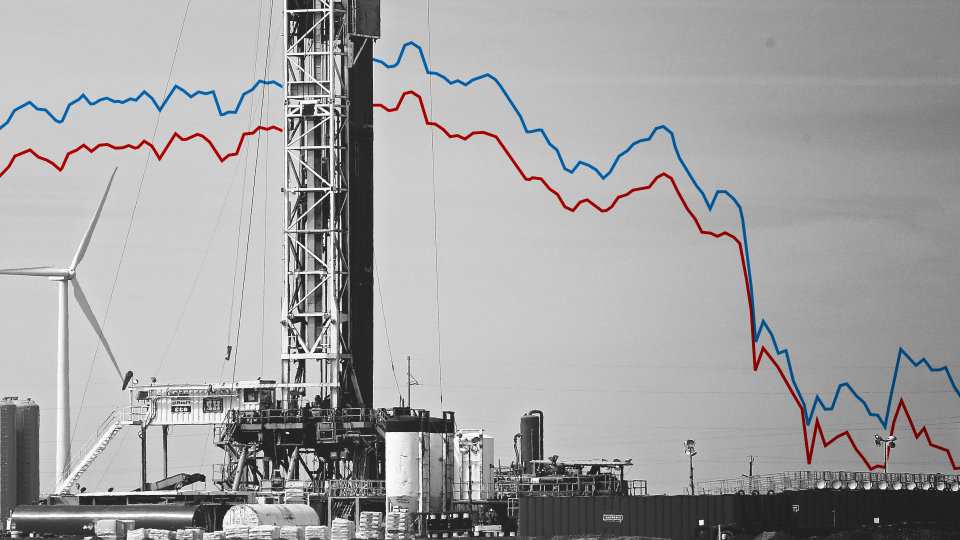

Oil slips to six-month low as recession fears weigh

KATHMANDU: Oil fell on Wednesday to a six-month low after a brief respite as concerns about the prospect of a global recession that would weaken demand overshadowed a report showing lower U.S. crude and gasoline stocks.

Figures on Wednesday did little to improve the economic backdrop, showing British consumer price inflation jumped to 10.1% in July, its highest since February 1982, intensifying a squeeze on households.

Brent crude was down 44 cents, or 0.5%, at $91.90 a barrel by 0815 GMT and earlier fell to $91.64, the lowest since February. U.S. West Texas Intermediate (WTI) crude dipped 9 cents, or 0.1%, to $86.44.

“The oil market is struggling to shake off recession fears, and there is little to suggest that this will change any time soon,” said Stephen Brennock of oil broker PVM.

Earlier, prices gained support from a report showing lower U.S. crude and fuel stocks. Crude stocks fell about 448,000 barrels and gasoline by about 4.5 million barrels, said sources citing American Petroleum Institute figures on Tuesday.

Official inventory data from the Energy Information Administration is out at 1430 GMT.

Oil has soared in 2022, coming close to an all-time high of $147 in March after Russian’s invasion of Ukraine exacerbated supply concerns. Prices have fallen since as those concerns were edged out by the prospect of recession.

“There are growing downside risks as a result of the growth outlook and ongoing uncertainty around Chinese COVID restrictions,” said Craig Erlam of brokerage OANDA.

On the oil supply front, the market is awaiting developments from talks to revive Iran’s 2015 nuclear deal with world powers, which could eventually lead to a boost in Iranian oil exports if a deal is reached.

The European Union and United States said on Tuesday they were studying Iran’s response to what the EU has called its “final” proposal to save the deal. Reuters

Facebook Comment