KATHMANDU: Over the last two weeks, the excess liquidity (investable amount) in banks and financial institutions has come down sharply. At the same time, market liquidity is under pressure. Owing to this, banks are also not getting inter-bank loans easily.

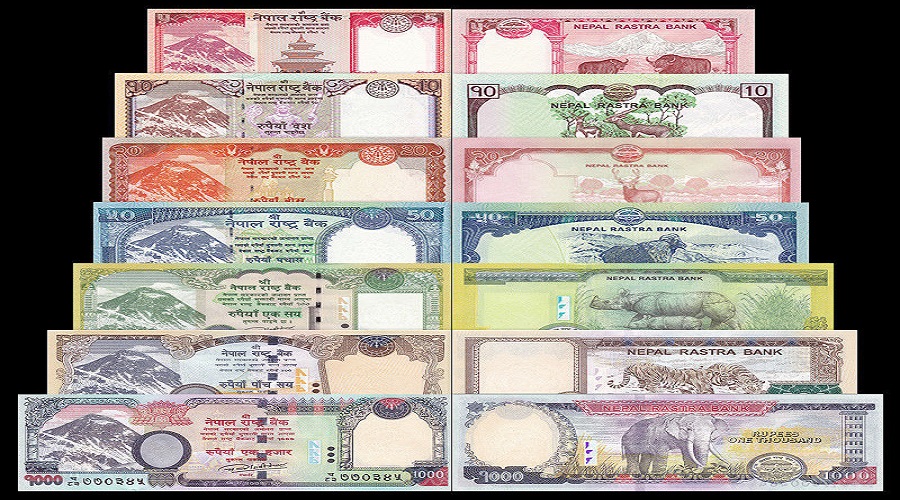

Last year during this time, banks and financial institutions (BFIs) had about Rs 200 billion excess liquidity. According to Nepal Rastra Bank (NRB), there is only around Rs 21 billion excess liquidity in the financial system as of today. This amount also includes the money that BFIs have taken from NRB through SLF facility which should be returned to the central bank within a week. Once BFIs return this money to NRB, it is certain that excess liquidity in the financial system will come down further.

BFIs are availing SLF facility from NRB to maintain loan-to-deposit-capital (CCD) ratio and the interbank interest rates has rise to around 4.7 percent.

Meanwhile, NRB officials have claimed that this problem will be solved soon as government expenditure will increase in the last month of the fiscal year. “There would be no pressure on liquidity as there was not much flow of credit from banks and financial institutions due to the lockdown. If the situation remained the same for a few days, the NRB will flow money into the market through other means,” informed a NRB official. .