KATHMANDU: The National Natural Resources and Fiscal Commission (NNRFC) has finalized the bases and the modality through which the central government will distribute revenue to the local and provincial governments. The commission has said that the detailed basis and structure for revenue distribution, once determined, will be valid for five years.

The structure and basis taken from the central government (fiscal year 2020/21) for the way revenue is to be distributed to the local and provincial governments will be implemented for the next five years, said NNRFC.

When the commission recommended revenue sharing modality in the previous fiscal year 2019/20, it was not able to fulfill the basis prescribed by the National Natural Resources and Fiscal Commission Act. At that time, the commission did not have exact data of fiscal federalism.

For the ongoing fiscal year, the detailed structure and basis has been drafted on the basis of the data received from the local and provincial governments last year. Accordingly, Rs 122.14 billion will go to the provincial and local levels from the central government for the current fiscal year.

In the current fiscal year, the government has set a target of collecting total revenue of Rs 1,011.75 billion and depositing Rs 889.61 billion in the federal government’s treasury.

As per the provisions of the NNRFC, the commission may review the detailed basis and structure every five years. However, there is a provision that the central government should request the commission to review it if it needs to do so within five years. Only then will the commission be able to review the basis and structure.

However, the commission has informed that the condition for such review will be available only once in five years.

Balananda Poudel, chairperson of NNRFC, said, “The detailed basis and structure of revenue sharing recommended by the commission to the federal government will be valid for the next five years.”

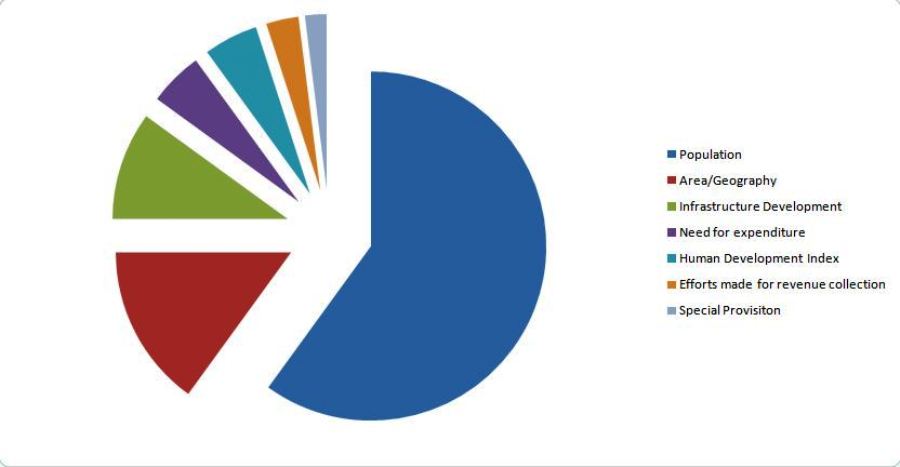

As per the act, revenue distribution will be based on population, geographic area, human development index, need and capacity for expenditure, efforts made in revenue collection, infrastructure development and special conditions.

As per the National Natural Resources and Fiscal Commission Act, local and provincial governments should cover the administrative expenses with the money raised from within their revenue authority as far as possible. If such cannot be sustained, the money received through revenue sharing basis should be spent for that purpose. Apart from that, other funds must be spent for development works.

“That is why the local and the provincial governments have to try to cover their expenses from their internal revenue sources as much as possible,” said Poudel, adding, the commission has prepared the structure accordingly.

As per the commission, data was collected from various stakeholders to prepare the structure. It has used data from the Central Bureau of Statics and other various governmental agencies and authorities.